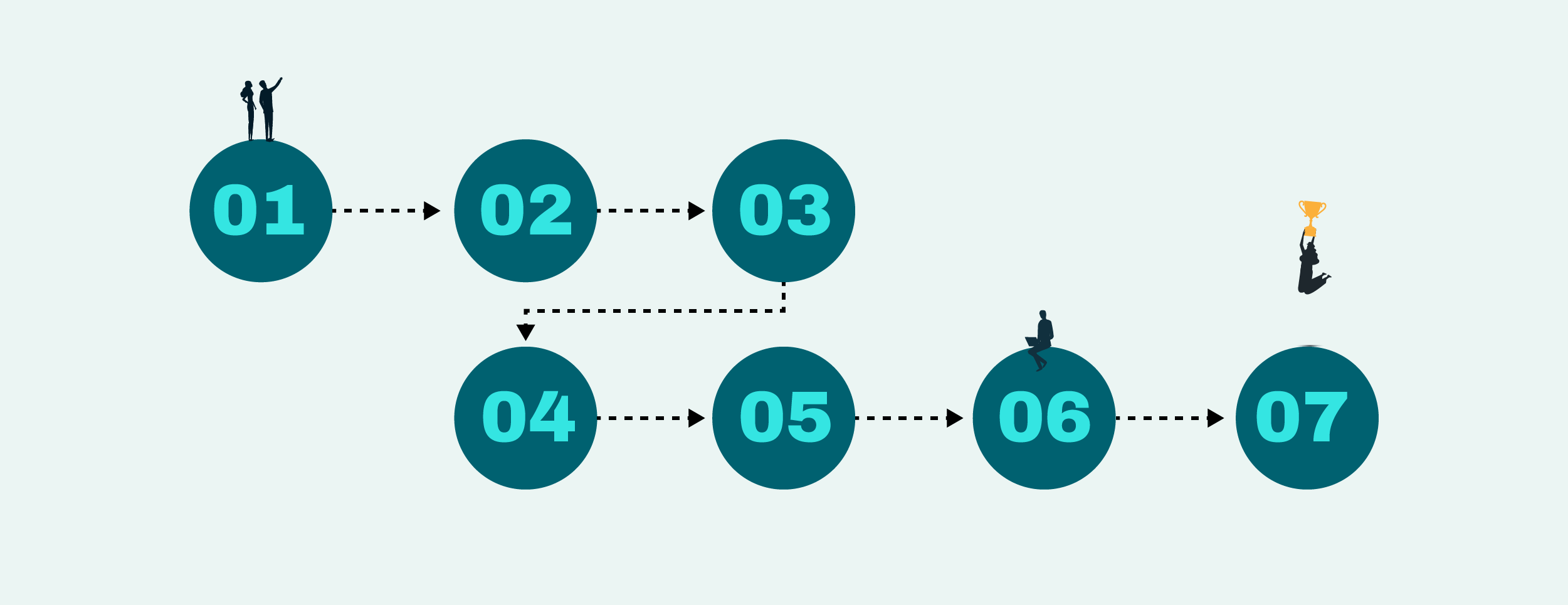

Understanding the record to report process steps: streamlining financial reporting for informed decision-making

The record to report (R2R) process encompasses the collection, validation, and consolidation of financial data, transforming it into actionable insights through comprehensive financial reports.

1. Data collection and recording

The foundation of the R2R process lies in the meticulous compiling and recording of financial transactions by the finance & accounting teams. This involves capturing data from various sources such as accounts payable, accounts receivable, payroll, and other financial activities. Each transaction is recorded in the general ledger, forming the basis of financial statements.

Accurate financial records are crucial for maintaining transparency and ensuring that all financial activities are tracked. Effective use of ERP systems can further streamline the data collection process, allowing for seamless integration of financial data across various departments.

2. Journal entries and validation

Once data is collected, it must be accurately recorded through journal entries. This step ensures that all financial transactions are correctly categorized and validated against supporting documents. The validation process is critical to prevent discrepancies and mitigate the risk of errors, ensuring the integrity of financial data.

Validation also involves checking intercompany transactions to ensure that internal trades and transfers are accurately recorded and balanced. This step is essential for maintaining the accuracy of consolidated financial statements.

3. Reconciliation

Reconciliation is a crucial step where recorded transactions are matched against external records, such as bank statements and vendor invoices, to ensure accuracy. This process helps identify and rectify any discrepancies, providing a clear and accurate financial picture.

Account reconciliation is a fundamental part of this step, ensuring that all accounts are balanced and that any variances are investigated and resolved promptly. Effective reconciliation practices contribute to smoother financial closing cycles and more reliable financial reporting.

4. Consolidation of financial data

The consolidation phase involves aggregating data from sub-ledgers and various sources into a central repository. This step is vital for creating a unified view of the organization’s financial health, facilitating the preparation of comprehensive financial statements such as balance sheets, income statements, and cash flow statements.

During consolidation, it’s important to compile all relevant financial records and ensure that intercompany transactions are correctly accounted for. This comprehensive approach ensures that the consolidated financial statements reflect the true financial position of the organization.

5. Financial reporting and analysis

After consolidation, the data is used to generate detailed financial reports. These reports are essential for internal stakeholders, such as management and the accounting team, as well as external stakeholders like auditors and regulatory bodies. Financial analysis during this phase helps in assessing the organization’s performance, profitability, and financial health.

6. Close process

The close process marks the culmination of the R2R cycle. This involves finalizing the books for an accounting period, ensuring all transactions are accounted for and adjustments are made as necessary. Efficient closing is critical for timely financial reporting and maintaining compliance with accounting standards such as GAAP.

A streamlined closing cycle, facilitated by robust accounting processes and ERP systems, helps in meeting regulatory compliance and ensuring that financial statements are prepared promptly and accurately.

7. Strategic decision-making

The ultimate goal of the R2R process is to provide valuable insights that drive strategic decision-making. Accurate financial reports enable organizations to make informed decisions, plan strategically, manage risks, and optimize financial performance. This data-driven approach enhances overall business agility and competitiveness.

The role of automation in R2R

Incorporating automation into the R2R process can significantly enhance efficiency and accuracy. Automation tools streamline data entry and workflows, reduce human error and the over reliance on tools like Excel, and enable real-time financial reporting. By automating repetitive tasks, finance and accounting teams can focus on higher-value activities such as financial analysis and strategic planning.

Automation also supports the integration of data across various systems and platforms, enhancing the efficiency of data collection, validation, and reconciliation processes.

Conclusion

The record to report process is a critical component of financial management, ensuring accurate and timely financial reporting. By understanding and optimizing each step—from data collection to strategic decision-making—organizations can enhance their financial operations, comply with regulatory requirements, and drive business success.

To see how Redwood’s finance automation solutions can streamline your R2R process and improve financial reporting accuracy, sign up for a demo today!

About The Author

Shak Akhtar

Shak Akhtar, General Manager of Finance Automation at Redwood Software, possesses extensive experience in finance and IT. With an accounting background with IBM and roles at SAP®, BEA and Wolters Kluwer/Tagetik, he brings a wealth of hands-on knowledge as he leads global initiatives in finance automation and record-to-report (R2R), facilitating client-led financial transformation.